If this blog gives you the information you are looking for, please share it on social media and let’s spread the word about this deceptive company.

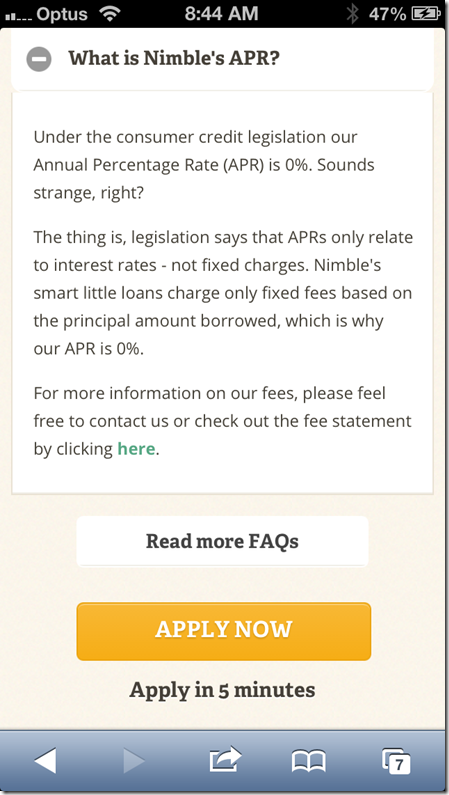

I get frustrated every time I see the Nimble ads on TV. Nimble is a loan shark company that charge outrageously for short term finance – generally between 17 to 50 days. But the ad doesn’t mention anything to do with costs or interest rates and their website toots the fact that the Annual Percentage Rate is 0%. Sounds fantastic right?

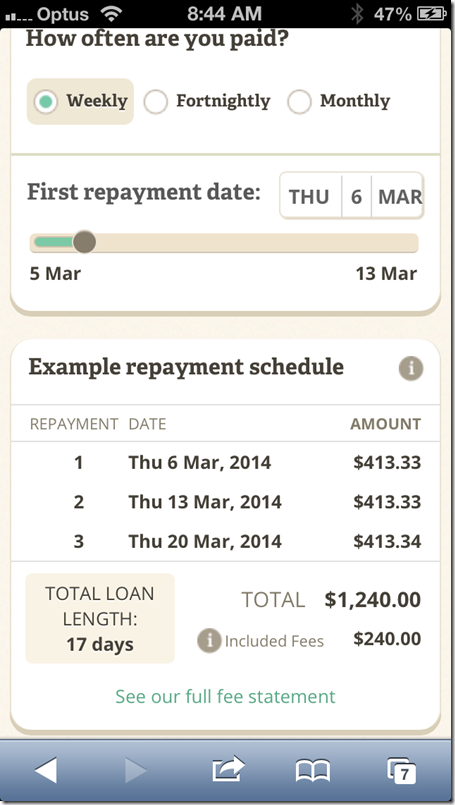

So from this we assume then that there is no interest charged on the money borrowed? So let’s work through some figures. Say I need $1000 for 17 days. According to the Nimble online calculator:-

So $1000 over 17 days is going to cost me $240 or to say it another way 24% over 17 days. If we annualised this it would be shocking – but to be fair we won’t do that. We will let Nimble do the talking. Again from their website we discover that for that $1000 the cost breakdown is 20% of the principal for Loan Establishment Fee and then 4% a month INTEREST – oh wait they call it “Monthly Loan Fee.” Well this “Monthly Loan Fee” works out at 36% per annum in addition to the 20% Establishment Fee. Which is a huge amount of interest on an apparent “Interest Free” product.

Nimble is a deceptive company preying on the vulnerabilities of people in tight financial situations. Even credit card interest is half of Nimble’s “Monthly Loan Fee and an unsecured loan from a bank is about a quarter of Nimble’s “Monthly Loan Fee.

I think the Australian Public need to know this.

I also have written a blog about Wallet Wizard, Loan Ranger and Cash Converters. Click here to read that blog.

Peter

If you found this blog helpful, informative or inspirational then I encourage you to share it on Social Media. I also invite you to subscribe to my blog so when I post in the future you will receive the blog as an email. I also love connecting through social media so find me on Facebook, Twitter or Insta. (just use my name).

Categories: Australian, Current Affairs

Totally agree with this one Peter. Have had similar concerns about these ads myself. My brother-in-law actually got caught in one of these in the USA and it literally took him years to get out of. His comment was that once you got a small loan, due to the ridiculously high interest rate, that on a fixed weekly wage, that it was “impossible to get out of”. In other words, based on someone who has a set weekly wage (or less), and assuming has fixed weekly other expenses, that it was mathematically impossible to pay back and close the loan. He was only able to finally get out of it when one day he got an unexpected financial bonus.

These types of companies usually sit on dirty looking streets, in poor suburbs. It’s unfair to the naive and vulnerable that Nimble is allowed to look cool and trendy. In any case – these companies and these types of loans should be illegal, as they create more financial strain on individuals, business and the government. I don’t think it’s too dramatic to say that they have blood on their hands.

Thank God for companies like Christians Against Poverty to actually do some good getting victims of Nimble (and others) out of the debt pit product they sell.

How does one obtain a loan when not a permanent Resident but employed part time on a 4 year study visa?

I totally agree – I’ve told my nieces and nephews of borrowing age to tell all their friends to stay away too.It’s outrageous!

Finally! People who think the same as me about Nimble. I thought they were great at first but when I thought about it and after they screwed me around with false advertising then when I made a complaint all they could say was “unfortunatly we are unable to help, have a good day”, i totally believe they are full of crap and preying on innocent people who are struggling. Smart little loans? More like Evil little loans. Dont do it guys youre better off without it.

Nimble have to pay back over a million dollars to people they overcharged .you know what you are going to be charged with them They say should borrow money from a bank smallest loan you can get from a bank is $5000 and they take the loan over 5 years .so you end up in debt for 5 years .you can pay it of quicker but most don’t .Banks need to lower there loan about to say $1000 or $2000 but they don’t because they are also greedy li used nimble and they helped me out when I needed it .iknow what iwas in for and was willing to pay also it was within 1 hour .pawn shops charge 20 % interest of goods you pawn also .The goverment has made it worse for people who need money in a hurry people that are unemployed can’t use nimble .so what’s the big problem with people that are working and know what they’re in for charges treating all as we are on the dole and spending there money .we earned it we spend it the way we like .if the goverment wants to help people get rid of pokies you introduced the problem to melbourne .no they won’t because there making to much money out of them .but pick on company’s that help you out .when you are in trouble .sure they are making money out of it .but not as much as them .you borrow acouple of times from nimble but then you do move on l

This is an unfair blog.

We at Nimble strive to help those in financial ruin with a means to pay short term bills.

There is nothing unethical about this – some people just need to read the fine print.

Happy Borrowing!

Yet you don’t tell me how its unfair

Nimble are rip-off, that is true, however my concern is their lack of respect for existing customers. I had 3 small loans through nimble, all of which were paid off on time and now I have applied for a loan which was declined due to “change in circumstances ” when my income has actually increased. What has really annoyed me is that they haven’t even had the courtesy to notify of any of this or reply to my emails.

##nimble boy obviously has time to reply to this blog- I don’t know what he’s doing when at work because I can’t get a reply!

if only people were smart enough to read your ‘fine print’ then we wouldn’t have a nation of morons owing you their wages & life!

If it was ethical, the “fine print” would be in large print in the front page. A loan shark by any other name….

dont be a wanker nimble boy you are getting people into more debt to pay offf in the long terrm Simple loan shark s sick of your addds on tv Ripped Off

You stilly little nimble loan shark. The very fact that you spruik a 0% APR whilst then charging a 4% monthly fee which equates to 36%pa interest rate is an unethical way of saying things… Oh and I forgot about the 20% establishment fee too. Bloody crooks you are!

it is unethical taking advantage of desperate people and then adding interest to the loan , it would be better if they only charged a flat $20 fee

If you really did strive to help those in financial ruin, your fees would be substantially less. If I borrowed $100 from Nimble, the minimum I could pay back is $124, as of February 2015. That, my friend, is not ethical.

To Tony and Jay – neither of you have any apparent comprehension of the costs involved in producing a small amount consumer contract. Some of the regulated requirements involve obtaining and verifying identification, obtaining and verifying income and the previous 90 days of bank account transactions, calculating the affordability of the loan based on the applicant’s financial circumstances, creating and executing loan documents, recording all the loan details and monitoring transactions and retaining the records for 7 years. That’s not to mention to cost of having the licence in the first place – licensing fee, external dispute resolution membership, professional indemnity insurance and compulsory professional development training. Then there’s business outgoings and wages. Then tax – not to mention absorbing GST on all costs as there is no GST charged financial supplies. Last but not least, there’s the risk that the person might never repay the loan. What’s not ethical is people shooting their mouths off about what businesses charge when they have no regard or knowledge about the costs involved.

Points taken, however – adverting your loans as being so simple and easy to acquire, especially to those close to apparent “financial ruin”, and sending them in to further “financial ruin” is hardly ethical. Soon I’ll be launching a loan service that is actually financially helpful, and affordable, to those in need. Then you might see how ethical my comments were after all.

You can’t just change your argument and walk away from it, and still bang on about ethics.

If you are seriously looking at starting a lending venture in this industry segment, I invite you to read the National Australia Bank’s report “Do you really want to hurt me? Exploring the costs of fringe lending”. The report was written based on the experiences of a not for profit NGO backed by free funding from the bank and an advisory group made up of various government and consumer bodies (including CHOICE, Brotherhood of St Laurence and Good Shepherd).

If nothing else, read pages 13 and 14 and bear in mind this was written before a lot of the increased regulation was implemented.

As an aside, the lender in the pilot still exists, is still backed by government, markets itself as charging “fair interest rates” and would charge $19.95 (if they did loans as small as $100) – http://www.fairloans.org.au. You may want to have a very hard look at your proposed business model.

Not walking away from anything. You’re basically saying it’s fine to advertise loans at any rate… *as long as the loanee reads and understands the fine-print*. I believe the reason many people get in to financial trouble is that they have effectively been preyed upon by very intelligent organisations with years of experience in how to best market their deceptive services.

An example is any of the major banks who offer their low-rate credit cards, even at 0%, to people with very low incomes. Once these people reach their credit limits – they make it oh so easy to increase their credit limit, which they are always conveniently offered in Internet banking, and in every phone call they receive form the bank, and in friendly letters.

Many people have not had even the simplest of financial education, and believe that they will soon be able to manage and pay off their debts, so they take the offers. But that often doesn’t happen, and they suddenly find that the bank has assessed that their risk profile is too high, so the credit-limit increase offers suddenly stop, and the harsh phone calls start, the forceful letters arrive, and the SMS and email notifications begin.

This is when they need a real break. This is when they need some low or no-cost, ethical help. This is NOT when they need a company to come along and offer them a quick-fix, when in reality – it is sending them deeper in to trouble.

24% is ludicrous. I don’t care what you say about your business case is at Nimble. It’s not right.

I’m not saying what you claim. In fact, I’ve been advocating a cap on returns for years. What I am saying is that denouncing what something costs while having no understanding of the cost of production is ignorant and dangerous. In very simple terms: You can’t sell something for $9 when it costs $10 to buy it, and expect to make any money.

I see your point, but isn’t claiming that someone else has no understanding of the cost of production, without knowing them or their background, is equally ignorant and dangerous? Anyhow – no need to get in to and endless argument loop, I thank we’ve made our main points and I have appreciated your replies.

Incorrect. You seek to profit from the financial difficulties of others.

Happy scamming!

Here is a company that prey on people who are unable to meet their financial commitments for whatever reason and push them further into debt. The only agenda that Nimble have is to cripple the already crippled and to profit from another persons financial distress. My wife made a loan through Nimble and had to take extra time to pay it back due to other financial commitments, Nimble agreed to extending the time and my wife paid it back in the agreed time frame. Now Nimble have sent her a further bill for an additional $600 for late fees, three months after the amount was paid in full.

Wow. And this story and others like it is why I wrote the blog

Wow. I feel for you Tony. Once I’m out of my financial mess I’d like to help people in serious financial trouble. It is almost entirely crippling to be under a lot of financial debt. I’m quite surprised there is no ethical place out there that helps people in serious need. It’s something I’m committed to help get going.

Jay I work in an organization that uses a program called NILS. No Interest Loan Scheme. It gives small loans with no interest and no fee. People only ever pay back the principal they borrowed. I am looking at expanding this program.

Nimble are rip-off, that is true, however my concern is their lack of respect for existing customers. I had 3 small loans through nimble, all of which were paid off on time and now I have applied for a loan which was declined due to “change in circumstances ” when my income has actually increased. What has really annoyed me is that they haven’t even had the courtesy to notify of any of this or reply to my emails.

They did initially do a 1 cent loan payment offer when they first started so you borrowed 600 and paid back 600.01 which was fair ethical and smart on your first loan

After that offer they are no different to any other pay day lender ripping the consumer off

Steer clear but I took advantage of that 1 cent offer which was awesome but a way to lure you back for more

Nothing new there. There was part of a story in the Economist recently that talked about this and it is common with this type of lender worldwide. People should do their own research before entering into any arrangement with any lender.

You must have overheard me yelling at the tv whenever those stupid ads come on. My colleague at work coordinates no interest loan scheme and so many ppl she sees who have credit issues have done these kind of loans. They deceive and enslave people!

Hannah where can we find out about this no interest loan scheme? So many people want to free themselves from the slavery if credit card debt.

Jay, this no interest loan scheme is NILS and you can only apply through a government Community Centre etc…The loans can only be used for essentials, like needing new fridge desperately, washing machine, paying utility bills, car repairs, medical/dentistry costs, rental bonds, rent arrears and so on…They are not for unessential uses. Not sure of credit card debt is included, but it might be….and you may need to be receiving some sort of Centrelink payment. Or partial payment…The ‘working poor’ might be included as well…btw, I have used Cash Converters a couple of times and it went smoothly!!! hahaha..But I didn’t borrow more than $600…I was never late with payment..But banks charge late fees too!!! .Yeah know I paid back etc etc, but I was grateful for the access as I am a low income person.. Banks don’t like low income people…and they are the ultimate sharks. They are damn killer whales actually…you almost cop a fee for walking inside one these days…they have hidden sneaky fees all over the place….All I know is a lot of people would be freezing in winter for example from not being able to pay a utility bill perhaps and the only place they could get the cash was from a Cashies loan…Charities have limits on the number of times you can apply to them for this type of assistance…Banks are HUGE corporations, they can charge less interest…Considering their size, they should be cheaper…

The business model is pretty straight forward. Grow it like crazy, flog it off before they alter the laws to shut it down completely once it starts to significantly impact on the traditional sharks like cash converters and the banks. I give it say three years maybe? Depends on its success and growth and whether it causes a major homicide in the meantime. Ridiculous but this is what you get.

WHAT A LOAN SHARK!!!!!!!!!!

Wow, calm down people! I was overseas days before Christmas two years ago and applied (over poor internet connectivity in the middle of basically nowhere) for a Nimble loan – my wallet had miraculously grown legs and went walkabout. I guess it’s not for everyone, but it helped me out when I desperately needed funds. Divert your frustrations elsewhere, like at Campbell Newman or why we aren’t doing enough to house the homeless and feed the hungry in Australia. Not at Nimble, because no one makes you apply for a “evil little loan” at gunpoint.

yep I agree mate they have helped me out, they are what they are you pay it back and there are no issues, they tell you what your repayments are before you agree to it, just people whom have taken it and not paid it back complain

Hey Nimbo

Sounds like you are really just another version of Nimble… Would like to just challenge you blanket statement that only those who don’t pay back the loans that complain. I have never had a Nimble loan and so I don’t fall into your category….yet I am complaining as Nimble is deceptive in its advertising and preys on the vulnerable.

Look i had a count of credit card fraud happy to be a month ago the day i was supposed to leave for a trip. Was told it would take 10 business days to get my money back. I was leaving the next morning!!

I borrowed $500 from Nimble. Had $120 interest on it, but it was in my bank account within 2 hours.

Absolutely huge and crazy interest, but it certainly got me out of a tricky situation!

Loan of $100 for 19 days. Total repayments = $124.

Well, I cannot imagine that they would apply flat rate interest, so I did a calculation on compound interest manually using their calculator. The ONLY way I could come close to getting the total amount of the repayments was to ADD the Establishment Fee onto the Principal. So, the establishment fee also accrues compound interest. Take into consideration that their loans are in terms of ‘days’, then compound the interest per day.

Comes out at an extraordinary loan rate of approx 415.6% per annum.

Little wonder there is NO information about this anywhere on their website.

MAkes for a REALLY interesting mathematics lesson.

Look Peter “Sam de Brito” agrees with you (http://www.smh.com.au/comment/nimbles-dumb-payday-loans-target-the-people-with-least-to-give-20150103-12emh5.html) dated 4 Jan. Now he’ll be famous.

I’m not going to defend Nimble, but there are a few wrong assumptions in the article and comments:

1. You can blame the government for the confusion regarding annualised percentage rate (APR) and the fees on small amount credit contracts (SACCs). SACCs are not allowed to charge interest by law so there is no APR. They are allowed to charge an establishment fee and a monthly fee, which are calculated as percentages of the amount of credit the person receives. So, while there are percentages involved they are not interest rates.

2. The level that the fees are set at was done arbitrarily by the government without having any regard for the level of compliance and documentation which is legally required in assessing and providing a loan. The amount of expense and work is no different for loans of 500 for 30 days, or $1000 for 6 months – fundamentally not far removed from a loan of $300,000 for 30 years.

3. Not only are the fees not interest, they are also not compounding. The fees are flat rates. In addition, there is a cap on the total amount repayable under the loan – the maximum repayable (including principal) is twice the amount the borrower receives, excepting enforcement expenses. For example, for a loan where the borrower gets $500 in the hand the most they will ever pay back is $1,000 (plus any actual enforcement expenses incurred by the lender).

Thanks, this was quite helpful. I’m actually doing research into the rise of online payday lending and I would be grateful if you could point me in the right direction regarding regulations/lending criteria perhaps with links to reputable sources. Are there any other “popular” companies like Nimble in Australia?

Hi Nick,

Your best bets for research are the legislation itself (Act – http://www.comlaw.gov.au/Details/C2014C00411 , Regulations – http://www.comlaw.gov.au/Details/F2014C00815) and the ASIC Regulatory Guides and Information Sheets:

– Guides, particularly 205 and 209 can be found here: http://www.asic.gov.au/regulatory-resources/find-a-document/?filter=Regulatory%20guide&credit=on

– Information sheets, particularly 101, 104, 105 and 146 can be found here: http://www.asic.gov.au/regulatory-resources/find-a-document/?filter=Information%20sheet&credit=on

What little else you may find is likely to be derivatives of these, and possibly biased.

Any internet search can give you a list of who is operating in Australia. The largest lender is Cash Converters.

Thanks! Much appreciated! Please let me know if there is a way I can reach out directly to you if I have any other queries.

I understand what you are saying. I have used Cash Converters a number of times and it has gone smoothly. These companies are not as HUGE as the banks, especially the big banks…The banks can charge less due to their size, or SO IT SEEMS!!! They have sneaky fees all over the place.. Cash Converter’s will not lend if all your debt repayments are more than 25% of your income..Might be something wrong with me but I don’t think paying $24 extra on an $100 loan is excessive…paying $50 would be though..

Based on your own screenshots, it seems they are pretty upfront about the costs. So are they being deceptive? I don’t think so. Are they preying on the desperate… well maybe. But these are people that need money fast for a situation, Nimble are providing a service and charging accordingly. They’re a private company not a charity. All that said, I cringe everytime I see their selfie ad…

I had to dig deeply to find the screen shots that I have used. Thats why I conclude they are deceptive. Up front they say there is no interest….that conveys something that is simply not the case.

Dig deeply? Who is being deceptive now. I got to the fee statement in 10 seconds with two clicks, and a fees overview in one. Do it with me: on their website, click “costs”. Then under FAQ, click the “click here” under “how much does it cost?”

senseandlogic you are forgetting that this was written in 2014. I have checked back to an archived version of the nimble website and it was not as easy to view the fees back then as you say it is now. For an advanced web user, it’s not too bad, but for the average person, I would say it wasn’t very obvious. But hey – when are fees and charges made obvious when you’re dealing with financial companies?

I find it interesting that Peter never takes up an argument with the more intelligent commentary on here. Just talks in sound bites or to people who agree with him.

I do fine it difficult to listen to anybody from COC when it comes to finance. An equally deceptive group of people who love to fleece the congregation via various techniques.

I remember sitting in many COC (now Citipointe) services as a lad hearing the Pastors fleecing people every week with their “Don’t rob God” power sermons.

I quote Niel Myers at one conference involving Ruckins McKinley “I believe there is 20 people here tonight who God is telling to give $1000 (insert mood music). Come on people, don’t rob God. Thank you Jesus (pray in tongues) Get your blessing tonight” blah blah blah and proceeded not to budge for 15 minutes until what he “heard from God” had adequately played out. It was gross, awkward and sad seeing people getting sucked into paying for their breakthrough like they could somehow coerce God into a 10-100 fold blessing just because the Pastor claimed to be hearing from God.

I have no issue with giving and no issues with the church. Both are beautiful at their best. But knowing what I know about your organisation (from being a leader in it’s youth ministry as a lad) it’s a bit rich hearing financial advice. Especially as your “not for profit” business pays off elaborate buildings and infrastructure with tax free dollars gathered by profiteering off other taxable professions like music, literature not to mention the above and beyond “donations” from hard working people or “partners” as you love to call them.

Don’t get me wrong… offerings to support ministry are a good thing especially when the money is being heavily repurposed to the communities in which they inhabit. I didn’t see this in my time at COC where building funds separate from the regular offering where elevated over helping the poor, needy and the broader community at large. All mixed in with images of the Pastor ushering the homeless to the far back corner away from seating in the front row reserved especially for his cheer squad leadership team yelling shallow amens and hallelujahs at his slightly humanistic sermons void of the essence of a loving and gracious father.

Allot of churches are business that wrap themselves up in the tax loophole of community service. I guess the difference between Nimble and these Churches is that Nimble isn’t trying to pretend it’s something else. It’s a service that people can choose or not choose to use.

I’d probably stick to talking about Jesus rather than throwing stones from glass houses.

Jimbo I engage with people extensively on Social media just not always on my blog site. So i am just trying to understand what you are saying in this comment, because Neil Miers took up an offering in an ugly way 18 years ago in a church in a different state in a movement that I was not part of at the time, I can’t have an opinion on Nimble? Do I have that correct.

Jimbo, I note your silence after bagging me out for not engaging in conversation. Interesting.

Jimbo I won’t take what you wrote the wrong way, as you requested – I’ll take it exactly as it came across: judgemental, foul-spirited, and an airing of a long-standing grudge that you’ve clearly had simmering for decades.

If you’ve got a problem with Neil Myers – go visit him. If you have a problem with Citipointe, go spend some time with them and air your concern. No idea who Neil Myers is, that’s just a bizarre link to this topic.

As for Citipointe – I have visited that community a number of times. I have given to their requests for donations, and I’m happy I did then, and I will do so in the future if I feel impressed to do so. You are essentially saying that Citipointe mismanage their money, and are quick to point out all the faults with their spending. From someone who is not part of their community, I can only say what I have seen from around the Citipointe area of Brisbane – the actual results of their spending. I’ve seen single mothers supported in times of great need. I’ve seen people staying at the Citipointe accommodation who have nowhere else to go. I see people so touched by what the leaders at Citipointe started that even just last night I attended a fund-raising event to raise money for the She Rescue Home in Cambodia, and heard stories about young girls who at the age of 10 have had to be sold to multiple men every night because the girl’s parents see no other way of gaining an income. As I understand, this home was started by the wife of the head pastor of Citipointe, and the fund-raiser was run by someone who is completely separate to the Church, and was touched by the great work being done in Cambodia by Citipointe when they visited there not long ago.

So to drag them through the mud like this is downright disgusting and cowardly, because you are not only bringing down Citipointe, but all large Christian organisations who occasionally get judged about how they ask for the required funds to continue their work.

Until you build an organisation of their size, or larger, that is genuinely helping people locally and internationally, please do not comment on the apparent financial speck in their eye.

And when you do, and you still have a problem with them, air it with them directly mate.

WHAT A SCAM – DONT EVER HAND OVER YOUR PASSWORD, IT MAY NOT BE THE COMPANY BUT AN EMPLOYEE THERE CAN ACCESS IT AND USE IT

We can expand this thread to include credit cards and the exorbitant fees one pays… Banks and credit institutions are, pardon my français, bastards. Like Nimble, they set out the amount of repayments plus interest etc and still people can’t afford the monthly repayments. Everything is laid out and YOU have the choice to accept or decline. Whether there is much forethought, if any, put into your decision, you are responsible for your own financial situation and the consequences of your decision to accept a loan. If you absolutely know that you cannot afford the repayments, then STOP there (the decline button should be clicked on at this point).

Agreed with the first half. But unfortunately banks prey on naive and inexperienced financial managers. They make it oh so easy to increase your credit limit – but as soon as you can’t make your repayments – they come down on you hard like a biatch. It should not be so easy for inexperienced people to get credit – banks are bastards who prey on those people.

Thirty years ago when Cash Converters started, a group of concerned antique dealers that I was part of lobbied Government to prevent their pernicious spread. Previously pawn brokers ,and that is what they are, charged a monthly percentage for loans on your goods. Cash Converters circumvented this by entering in to sale contracts not loan contracts. They would buy your goods for , say $500, keep them and sell them back to you next month for $600, more than pawn brokers could legally charge. This has now expanded as financial markets were freed up and it seems anyone now can set up in a shop front and loan money to people most likely to default .Its an incredibly profitable business that attracts people with no moral compass and no amount of Weasel Words from the operators will alter my low opinion of them all . The Big Banks are no better.

Hello.

Do you need personal or business loan without stress and fast approval? If so, please contact us as we are now offering loans at prime interest rate. Our loan is secured and safe, for more information and applications, please reply to this e-mail. (privateloaninvesment@outlook.com) the name and amount needed.

contact us today (privateloaninvesment@outlook.com)

Good blog. I saw a job ad for Nimble and wondered what they were about. Aside from fixed costs like lawyers to chase up non payments, staffing costs etc the ethics of charging someone $240 for a 17 day loan of $1000 aren’t something I can support or defend. Better rates than Wonga in the UK so well done to them but not somewhere I could work based in my value set.

Great tip about Christians against poverty for everyone who truly needs financial support.

Very disappointing reply from the nimble representative – trying to argue your company treats people fairly is a dead end conversation. Laughable business ethics all round – completely unprofessional but….. not surprised.

Thanks again from everybody for the great tip

If they want to be considered legitimate and ethical why not explain that you could be charged an effective interest rate of 400% or more p/a.

Forget the “business model” bs Nimble are preying on the weakest part of society. I hope the people involved really have convinced themselves they are only trying to help people. Otherwise it would be hard to live with the fact you have preyed on the people who can least afford it.

Completely agree.

In answer to your question: because they’re not charging “an effective interest rate of 400% or more p/a”; or anything like it. An “effective interest rate” is a calculation which involves internal compounding, is not a term recognised in the legislation and is inconsistent with the way in which charges on Small Amount Credit Contracts (SACCs) are levied.

SACCs cannot charge interest and the fees which are chargeable cannot be compounded. This alone means that their charges cannot be converted into an annualised percentage rate and get anything approaching a sensible answer. For instance, the establishment fee is excluded from having any time based charge levied on it by law. Accordingly, it is unable to be compounded.

The Federal government has specifically addressed and acknowledged that you cannot equate SACC fees to an interest rate per annum. In a document I obtained under freedom of information, they acknowledge “[t]he 20/4 model is based on fees rather than interest, so that the comparison with a credit contract, in which interest can be charged … is not relevant.”

The maximum term of a SACC is limited to 12 months. Couple that with the maximum charges allowable and the maximum annual charge under a SACC is 68% of what was obtained (20% establishment fee + 12 lots of 4% monthly fees). That’s not a rate of interest – that’s a flat percentage. This is a long way short of the “400% or more p/a” that is being claimed.

To add to this, the maximum amount payable under a SACC is capped (barring enforcement expenses) at twice the amount the consumer actually receives. This means: no matter how long it takes to pay back, you never pay back more than double what you got.

If anyone still thinks 68% is too high, read my earlier comments.

Borrow anything up to € 1,000,000,00 Choose between 1 to 50 years to repay.* Choose between Monthly and Annual

repayments Plan. * Flexible Terms CONTACT: michelle.ent.hall@gmail.com

THANKS.

Aside from the ethical debate of lending small amounts of money, mostly cons with one pro, the issue that first hits me is the slogan, Nimble it and move on. I am happy to move on but Nimble wants its money back. Can you say to them, I’ve spent it so move on? The premise of the add is to forget the fact that you can’t afford it, just get locked in.

this is a nice discussion, I have been keeping eyes on this industry for the last 12 months.

those who don’t know the legislation needs to get to know them. you need more than a PhD, and you still would not understand those documents, most lawyers cannot tell you what they have read in those docs. The career politicians spent their lives exploiting the moronic Australians. Different section of the finance industry are just at each other’s throats, blowing their own horns (including the OP of this thread); try to run a for-profit entity, instead of waiting for handouts. The big banks are the backbone to kill this tiny sector. What would happen if this tiny sector has been killed off? Yes, the big banks make billions of dollars in profits and the morons don’t say much, but most these tiny operators don’t even reach the million mark and all eyes are on them?

this post just illustrated the laziness of Aussies who expect every word in their contracts to be read and explain to them. aren’t the contracts of SAAC regulated by the very government you elected to office?

I am neither a lender nor a lendee in this industry.

There are so many salaried people who get roped in unwanted economic conundrums all of a sudden due to their

abysmally low salaries according to their entire monthly expenditures.

Everything can be done in the comfort of his home or office.

There are two famous ways of gaining cash

but people prefer to go with the online mode.

Peter you would also have to include wallet wizard

Absolutely. When I wrote the blog a couple of years ago, Wallet Wizard wasn’t around..

Yes you are right. When I wrote the blog, Wallet Wizard didn’t exist. But it is just as bad.

thank you. comment deleted

They dont check ID properly giving loans on stolen expired ID ….false phone nr..false email. ..what is wrong ..pure greed

Hi Peter, very informative, congrats!

But my concern is the fair attitude of the customers that have been duped, decieved, ripped off…or any other word or phrase you may think of.

Companies like this exist due weak governing laws, that should protect cnsumers though sadly, unless you rub shoulders whth the Who’s Who brigade, the government couldnt care less about you.

Needless to say, i couldnt care less about my greedy, out-of-touch government, and the dirty businesses they spawn.

So since its the poor who are targeted by these companies, a person who becomes trapped in repayments, should just give them the finger, true! What are the sharks gunna do?? Sue u? Hardly…take u to court where their cnntracts wil be scrutinised? Nah, dont think so. The people have the power, so dont get frustrated Peter, to rid our nation of this vermin, take the money that they themselves were trying to rob from you. Poor people arent afraid of the debt register. B

Btw Peter, you may think im over-simplistic on my previous comment or as bad as the credit sharks, but just so you know, im also a shark, and i eat other sharks 🙂

Any suggestions on where to go for a decent small loan? $2000 with good credit in a casual work position? thanks

Ross, your best bet is one of the Aussie banks.

Looks as if Nimble was not so Nimble… http://asic.gov.au/about-asic/media-centre/find-a-media-release/2016-releases/16-089mr-payday-lender-nimble-to-refund-15-million-following-asic-probe/

Well if you get to greedy it comes back to haunt you .Looks like Nimble has to be humble and pay back 1.3 million dollars to over 7000 clients . Because didn’t look in to there finances to see if they could afford to pay them back .Look ihad afew Quick loans and paid them back .but hated being policed by govement .borrowing say $150 and was rejected .also think the banks should be fined also for allowing nimble and other company’s to access your account and seeing how much you have in the bank .How much kick back where they get ting .Didn’t mind paying back nimble there 20 percent interest .but think it was arip off charging 4percent interest also .per month on top of that .Looks like the party is over .The rich get richer and the poor get poorer .

Won’t break copyright laws by copying and posting the image here but have a look at yesterday’s Non Sequitur, quite good actually 🙂

http://www.gocomics.com/nonsequitur/2016/03/24

I heard that Nimble was fined and ordered to pay back some monies to their customers. Is this true? If so who is eligible and when will they be paid?

Yes they were. Google ruling against Nimble.

Yes I hear the short term lending industry is the most scrutinized and most heavily regulated. But they do stuff up, and they will always be caught out when they do. Shame same does not happen with other mainstream lending. Adults should be able to make there own choices. The fact Peter has a blog on this is very concerning. There is much more in life to whinge about. Get a grip lol

Yes there is more to life to whinge about but I smile at the irony that you are spending time right now whinging about my blog.

Think banks should be in trouble to for allowing nimble and other company’s being able to look at your accounts also .if they refused people wouldn’t be able to access.money within 1 hour .Banks must be making heaps of money as well .

My first nimble loan was approved for $400 but they charged an extra $240 in interest and paid it back in 3 weeks that was last year. Now when I first applied somehow my DOB was completely wrong so I changed it yesterday and guess what it got declined because of my credit history which has 1 single defult from 2011 which will drop off in June this year. Since last year my first $400 loan with them I’ve managed to go up to $1200 (rising by $200 @ a time) I have never made 1 late payment when I changed banks I notified them before the money was due that week never defaulted with them and paid $240 each time I took out a loan with them but since I changed my DOB last night they refuse to give me another loan despite having a very super clean track record with them and paying their fees.

Joe, I think you either have your facts mixed up a little … or you need to go straight to ASIC. The maximum charges allowed on a $400 small amount loan for 3 weeks is $96.00 – not $240.

Let adults be adults. You’re on a witch hunt Peter. I have used theses loans in the past and I am glad they are available. Find something better to do with your time.

Jeremy if you read some of the above comments, you will clearly see there is a lot of pain involved in this company, so accuse me all you want. I found this blog was a good use of my time. But thanks for caring enough as to help me with my time management.

You are a self righteous prick. Are you going to lend me money for accommodation due to a family break up?

Wow it didn’t take long for the name calling to start. I am out of this conversation.

And for the record the organisation I work for does No Interest Loans.

I will, if you really need it. I’ve been one of the people commenting on this post over the years. I’ve been in serious financial pain, and almost made the mistake of getting a Nimble loan. It’s fine for some, perhaps those like yourself, but for others it sends them further in to anguish. Financial pain is some of the worst in our society because it is so utterly debilitating. Especially when you have financial institutions constantly on your back because you can’t pay your credit card interest – the same credit card where they went out of their way to offer you more credit when they very well knew your spending patterns indicated that you likely would never get back out of the red.

Once I am financially free myself, I have made a pact to help others get out of genuine trouble, and it’s partly because of this blog. So please be a little more careful when shooting your mouth off. Peter seems to be a genuine guy who does care. I don’t know him, but I’ve learned that much about him over the years.

As I said though – if you really need help, I can help lend you a little money.

Jay I do understand what you are saying. Peter I apologise for the name calling.

I agree that these companies do engage in irresponsible and probably even predatory lending at times and I am glad they are heavily regulated and scrutinized. But they can also offer a service to the right applicant to get them out of a spot of bother so long as it’s used sparingly and only in emergency. There is a lot of Nils lenders out there that will assist pensioners so I think they should be not eligible for short term sacc lending (I don’t want the countries taxes finding the repayments). But for EMPLOYED ADULTS of sound mind and and a clear understanding it should be their choice. IMO it is no different than taking out credit cards or other personal loans (which are no where near as heavily targeted by asic etc)

I don’t want to to have to borrow a min of 3k off my bank over 5 or so years. I want a 1500 paid back in 3 months. I don’t want this option taken away.

Yeah it is a good thing that they’re heavily regulated. I agree with you – the loans could be great for the right kind of person with a healthy ability to earn money. But not everyone is like that, and from memory – the Nimble advertising and website used to all but hide the true cost of their offers, which makes it very attractive to the financially (and otherwise) uneducated.

You’re right about the lack of asic credit card targeting – it’s ludicrous how much credit card debt Australia have. It’s an absolute shame.

I find the ads to be ridiculous! Credit card debt is out of control and I can’t wait for all the big lenders to be cracked down on. So many people live out of their means. Back on topic, I think the biggest issue with short term lending is their screening / approval guidelines. The wrong people are getting approved and not being told the alternatives ie. Nils. And repeat payday lending is another issue. This usually would indicate poor money management and/or gambling, drugs, shopping addiction etc and I believe the short term lending industry really needs to tighten up in this as it is only giving them a bad name and reasons to have blogs like this.

Not to mention enabling these peoples addictions and bad habits.

Completely agree.

These guys are digital loan sharks operating in an environment where there is an epidemic of drug use in our youth and young adults. They legitimise themselves with corporate communications and their IT capability. They are digital detritus

Do they report to APRA or any other regulatory authority in bad debts?

No one does anyone a favor..

Especially the times we live in..

Money makes the world go around. .

To make that world go around how many people’s life has to be ruined. ?

I am 100% against the greedy lenders preying on the vulnerable.

It’s a cruel world we live in…

Companies like Nimble has given rights by the government we trust to rob us without any guns…

No difference between a Robber & Nimble loans

UNICREDIT FINANCIAL SERVICES.

UNICREDIT Financial Services is a Register / Accredited Financial

Company Which Provides a high standard of financial (LOAN) services to

private and corporate clients. Do you need funds as investors? Are you in

financial mess? Do you need a loan? We offer loan from the range of $5,000

to $50,000,000 (USD, EUR, GBP) OR EQUIVALENT IN OTHER CURRENCIES. We offer

loan at an annual basic interest rate of 3% from a duration of 1 to 35

years to clients serious and trustworthy! Clients are require to pay back

our loan repayment by monthly installment after 6 months of receiving his /

her loan funds. Interested borrower is advice to forward request to us via

e-mail: unicreditfinancial@yahoo.com

Welcome To UniCredit Loan Service…

Are you a business man or woman? Are you in any financial mess or do you need funds to start up your own business? Do you need a loan to start a nice Small Scale and medium business? Do you have a low credit score and you are finding it hard to obtain capital loan from local banks and other financial institutes?.

Our loans Are well insured for maximum security is our priority, Our leading goal is to help you get the service you deserve, Our program is the quickest way to get what you need in a snap. Reduce your payments to ease the strain on your monthly expenses. Gain flexibility with which you can use for any purpose – from vacations, to education, to unique purchases.

We offer a wide range of financial services which includes: Business Planning, Commercial and Development Finance, Properties and Mortgages, Debt Consolidation Loans, Business Loans, Private loans,car loans, hotel loans, student loans, personal loans, Home Refinancing Loans with low interest rate @2% per annul for individuals, companies and corporate bodies. Get the best for your family and own your dream home as well with our General Loan scheme.

Interested applicants should Contact us via email:(unicreditfinancial@yahoo.com)

need a real loan shark

Peter all loan companies are locked to 24% interest by the govt as a start off. INCLUDING NIMBLE

you say 36% calculated if you calculate annually but as you and Nimble have established THEY AREN’T calculated annually. they are calculated based on how much the borrower get which is, at it says on their website a 20% application fee and 4% monthly fee. They are just as expensive as all other loan companies. they all sort the payments and fees out differently to appear cheaper but all of them will cost around the same amount. if people dont like it then they can either 1. get a bank loan or 2. save money and dont depend upon small loan places. I hate people depending upon others and then expecting favours like the world owes them shit.

Businesses make money thats how they work. loan companies are no different they are businesses which are carefully monitored by the govt to make sure they don’t overstep boundaries placed. Also All SACC (small amount credit contract) providers cannot charge more than 100% of the initial loan amount no matter how long the customer takes to pay off the loan.

The only loan company i know of that gets around these fee boundaries placed by the govt is Cigno/Teleloans, as they have some legal bull which makes them technically not a SACC provider so they can charge whatever they want without being able to be sued or shut down for it.

I know you’re trying to help, but you’ve got it wrong. SACCs can’t charge interest. The percentages quoted are flat fees – not interest rates charged on outstanding balances (like other loans). All fees are calculated on the amount the customer receives, at the maximum rates of:

– 20% for establishment;

– 4% per month the loan is outstanding; with

– Maximum charge of 100% of the amount obtained no matter how long it takes to collect. This is inclusive of any default charges but excepts enforcement expenses (eg court filing fees).

There is no publicly available study, anywhere, as to the profit margin achievable on these loans nor the costs of providing them. Therefore, no one can comment about how much of a ‘rip-off’ a SACC is.

Amazing reminders on what to put on mind about the debt calculator and it really helped! Great article! Indeed, very helpful and informative. Easy to remember! Cheers!

I absolutely detest this ads. Wallet Wankers I call them. Sadly we have a ‘stupid’ generation out there that have no idea when it comes to money. So sad.